Thaxpayers are expected to perform the primary tasks that were previously handled by the tax authority which emphasizes on completing tax returns accurately including. Noor Sharoja Sapiei Faculty ofBusiness andAccountancy University ofMalaya Malaysia.

Basic Questions On The Growth And Development Of Economics Free Udemy Coupon Code Economics Free Online Learning Udemy

There are three type taxpayer which are companies.

. Self Assessment System Sas in Malaysia. This study seeks to. Reduce tax collection costs to hasten tax collection and reduce uncollect able taxes and to.

In the 1999 budget it was announced that the official assessment system under which taxpayer were assessed to income tax under the Income Tax Act 1967 by the IRB based on the tax returns filed by them was to be relpaced by the self-assessment system. Under the SAS individual who has income accruing in or derived from Malaysia are required to disclose taxable income honestly compute tax payable correctly file tax return form and pay tax on a. Reforms and changes in tax laws may affect the level of complexity in the tax system and increase taxpayer compliance costs burden.

Malaysia has adopted an Official Assessment System OAS whereby taxpayers were assessed by the tax authorities based on the tax returns filled by them. C Malaysia 95 25 SELF ASSESSMENT SYSTEMS AN INTERNATIONAL COMPARISON 97 251 General tax administration 97 252 Registered taxpayers 100 253 Unpaid taxes 101 254 Efficiency and administrative costs 102 255 Measures to promote compliance 104 2551 Enforcement and penalties 104. Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company.

This study seeks to explore and identify the key dimensions that determine the service quality of the Inland Revenue Board Malaysia IRBM under the new Self-Assessment tax system. The system has been effectively implemented effective from 2004 onwards. Under the formal system taxpayers are required to declare their income in the Return Form submit the Return Form to the Inland Revenue Board IRB and IRB will then raise the assessment.

Self Assessment Tax System. Malaysia applies the self-assessment system SAS in its tax administration. Prior to 2001 Malaysia adopted an official assessment system whereby tax payers are assessed to income tax by the IRB based on the tax return filed by them.

In Malaysia the introduction. The amount of tax payable for the year must be self-computed and the tax return is deemed to be a notice of assessment upon its submission. Self assessment system SAS has become the key administrative approach for both personal and corporate taxation in developed countries including the USA UK and Australia.

The self-assessment system is essentially a process by which taxpayers are required by law to determine the taxable income compute the tax liability and submit their tax. Under the SAS individual who has income accruing in or derived from Malaysia are required to disclose taxable income honestly compute tax payable correctly file tax return form and. Professor JeyapaJan Kasipillai School ofBusiness Monash University Malaysia Abstract.

This new strategy require taxpayers to take more responsibility for getting their tax returns. Revenue Board Malaysia the IRBM has implemented the self-assessment tax system the SAS on individual taxpayers in order to promote voluntary tax compliance. The tax return is submitted not later than 30.

The scope of. The tax return is deemed to be a notice of assessment and is deemed served on. IRBM has implemented the self-assessment tax system the SAS on individual taxpayers in order to promote voluntary tax compliance.

The amount of tax payable for the year must be self-computed and the tax return is deemed to be a notice of assessment upon its submission. Self Assessment is a total process change from the previous formal assessment system. Malaysia adopts the self-assessment system where the taxpayer is responsible for computing ones own chargeable income and tax payable as well as making payments of any balance of tax due.

Introduction At the time of the Malaysian governments Look East policy in the 1980s1 there were calls for the introduction of a self-assessment SA system of taxation modelled on that of Japan2 These calls were aimed at enabling the Malaysian Inland Revenue Department3 to deploy its staff to more productive functions. Central to the motivations of self assessment system. The Malaysian Government has introduced a Self Assessment System SAS in stages commencing with companies from 2001.

Australian Journal of Basic and Applied Sciences 57. Self assessment system msia tax 1. The Self-assessment System Dr.

Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. A Notice of Assessment is sent to the taxpayer and based on the tax. This approach emphasises both the taxpayers responsibility to report their income and the need for them to determine their own tax liability.

In Malaysia the self-assessment system is introduced to achieve three main targets which are to. 881-888 2011 ISSN 1991-8178 A Study on Self-Assessment Tax System Awareness in Malaysia Choong Kwai Fatt and Edward Wong Sek Khin Faculty of Business and Accountancy University of Malaya Kuala Lumpur Malaysia Abstract. Malaysia adopts the self-assessment system where the taxpayer is responsible for computing ones own chargeable income and tax payable as well as making payments of any balance of tax due.

What Is Marketing Automation How Does It Work

Self Assessment For Directing Health Professionals Learning C Download Scientific Diagram

Posturescreen Uses Augmented Reality Assisted Posture Analysis For Assessment Evaluations App Software For Iphone And Ipad Postureco Inc Posturescreen Leanscreen Remotescreen Squatscreen Postureray

Control Self Assessment Deloitte Australia Our Services And Solutions Risk Solutions Risk Management Assessment Reporting

Islamic Finance The Unconventional But Nascent Financial System Borneo Post Online

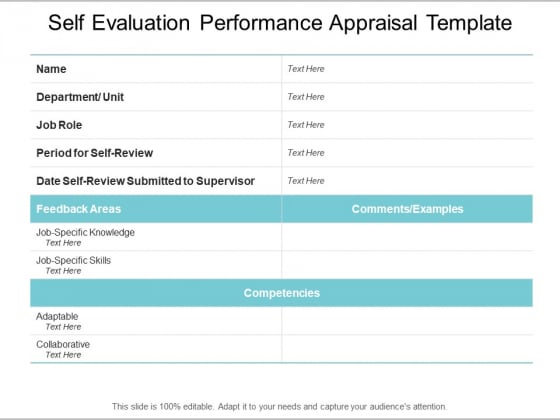

Self Evaluation Performance Appraisal Template Ppt Powerpoint Presentation Slides Vector Powerpoint Templates

Self Assessment For Directing Health Professionals Learning C Download Scientific Diagram

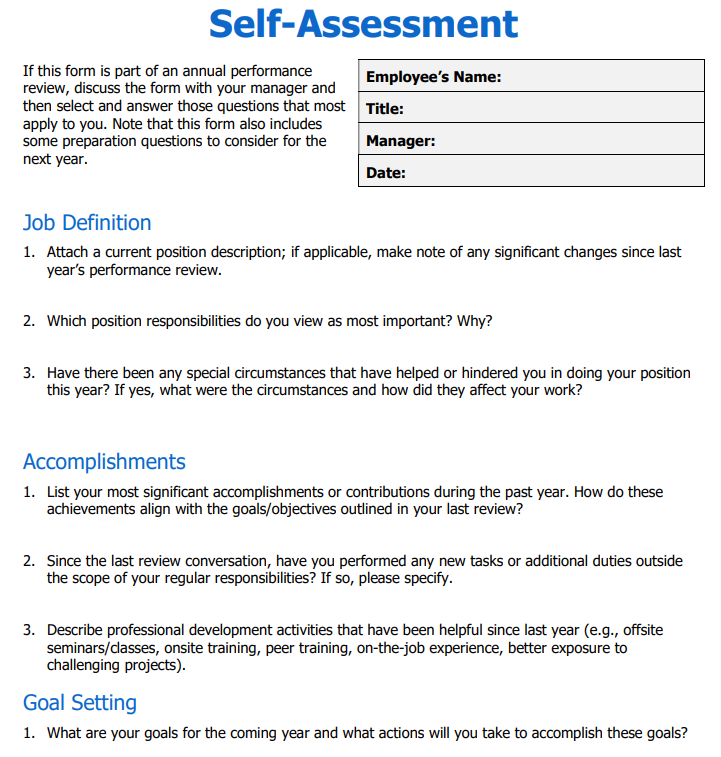

Sample Employee Self Evaluation Form 14 Free Documents In Word Pdf Evaluation Employee Employee Evaluation Form Self Evaluation Employee

Self Assessment For Directing Health Professionals Learning C Download Scientific Diagram

The Perfect Employee Evaluation Form Templates How To

Student Self Assessment Survey

Types Of Income Tax Assessment Objectives Time Limits Legalraasta

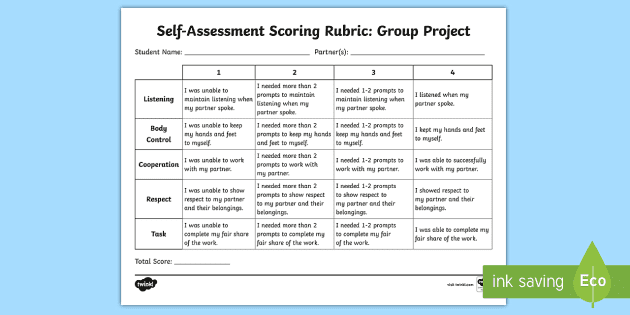

Oral Presentation Rubric Teacher Made Twinkl

Payroll Software Malaysia Realize Your Best Performers For Appraisals And Promotions And Move Your Company In The Right Directio Payroll Software Payroll Hrms

Infants And Toddlers In The Policy Picture A Self Assessment Toolkit For States Zero To Three

10 Self Evaluation For Performance Review Examples With Tips To Write Talent Economy

Research Project Student Self Assessment

Marzano Scale Student Self Assessment Rubric Kids Student Self Assessment Assessment Rubric Student Self Evaluation